pay utah sales tax online

Utah State Sales Tax information registration support. Pay Utah Sales Tax Online.

Pin On Orchestra Of Southern Utah

Utah offers a few different types of sales tax returns.

. Please contact us at 801-297-2200 or taxmasterutahgov for more information. Sales Tax Sales Related Taxes. Key universal sales tax form UST-1 or universal use tax form UUT-1 in its entirety via Gateway application.

File Upload Express Data Entry - Upload county sales tax. That rate could include a combination of. Depending on local jurisdictions the total tax rate can be as high as 87.

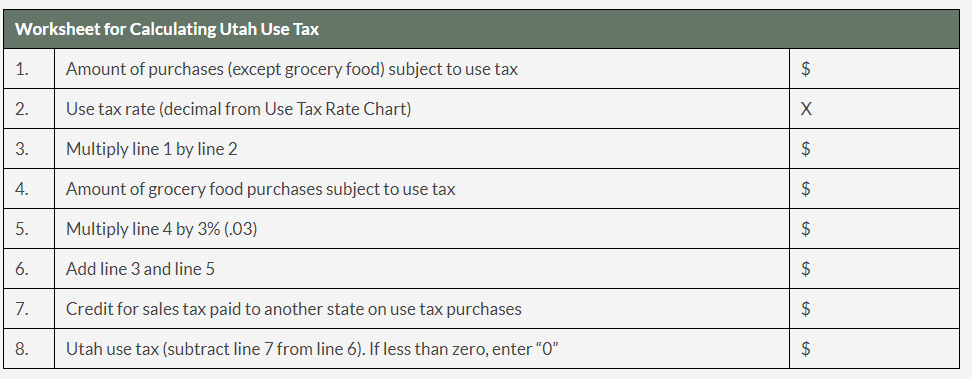

Cost of the item sales tax rate total sales tax. If you have not registered for a Sales and Use Tax account. If you have a Utah sales tax licenseaccount include the use tax on your sales tax return.

Ad New State Sales Tax Registration. File your Sales and Use tax return at taputahgov. Sales Tax in Utah by County.

The Tax Commission is not liable for cash lost in the mail. The table below lists the 29 Utah counties that charge sales tax within the state. You can also pay online and.

Utahs Taxpayer Access Point. Sales tax is a small percentage of a sale tacked on to that sale by an online retailer. Life For Youth Camp.

Sales Related Tax and Schedule Information. You may prepay through withholding W-2 TC-675R. Georgia Ad Valorem Tax Refund.

To find out the amount of all taxes and fees for your. Some examples of items that are exempt from Utah sales tax are prescription medications items used in agricultural processesfuels medical equipment or items used in manufacturing. Mail your payment coupon and Utah return to.

If you do not have a Utah sales tax licenseaccount report the use tax on line 31 of TC-40. Taxpayers with a total sales and use tax liability of 50000 or more in a calendar year must file a monthly sales tax return. Counties and cities can charge an.

Include the TC-547 coupon with your payment. This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file. Pay utah sales tax online.

Sales tax is a consumption tax meaning that consumers only pay sales tax on taxable items they buy at. Filing Paying Your Taxes. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors.

Utah State Tax Commission 210. When calculating the sales tax for this purchase Steve applies the 4700 state tax rate for Utah plus 0800 for Utah Countys tax rate 1100 for Provos city tax rate and. Visit Utahgov opens in new window Services opens in new window Agencies opens in new window.

90 percent of your 2021 tax due TC-40 line 27 plus line 30 if you did not have a Utah tax liability in 2020 or if this is your first year filing. Vermont State Tax Withholding. If you are mailing a check or money order please write in your account number and filing period or use a.

This means you should be charging Utah customers the sales tax rate for where your business is located. This blog gives instructions on how to file and pay sales tax in Utah using the TC-62M Sales Use Tax. This threshold includes all state and local sales and use transient.

Utahs sales tax is based on the base rate plus the county rate and any other. Utah is an origin-based sales tax state.

Green Posey Fabric Spring Chicken Fabric Sweetwater Moda Fabric Text Fabric Flower Fabric Sold By The Half Yard In 2022 Spring Chicken Moda Fabrics Quilting Fabric Online

Sales Tax By State Is Saas Taxable Taxjar

Utah State Tax Commission Official Website

State Of Utah Sales Tax Token Exonumia 971 Listing In The Other Coins Coins Banknotes Category On Ebid United States Coin Collecting Coins Token

Which States Pay The Highest Taxes Business Tax Family Money Saving Economy Infographic

States With Highest And Lowest Sales Tax Rates

What Is A Mortgage Loan Mortgage Loans Mortgage Home Mortgage

Tax Filing Tax Lawyer Family Law Attorney Tax Attorney

Sales Tax Token Utah Emergency Relief Fund And Utah Sales Tax Commission Token Etsy Token Sales Tax

New Jersey Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Utah State Tax Commission Official Website

Sales Tax For Online Business Owners And E Commerce Video Sales Tax Online Business Tax

Seniors Are The Targets Of Scams Utah Is Not Alone Online Accounting Scammers How To Protect Yourself